When parents in Ohio divorce or separate, child support for college expenses becomes one of the most pressing financial concerns for their children. While most parents understand that standard child support covers essential needs until the child’s 18th birthday, the question of college tuition and post-secondary education support creates confusion and potential conflict.

Does Ohio child support cover college? Can courts force you to pay for your child’s university education? This comprehensive guide from The Meade Law Group answers these critical questions for Ohio parents in Columbus, Cleveland, Cincinnati, and throughout the state.

Understanding Child Support Obligations in Ohio

In Ohio, child support obligations typically terminate when a child turns 18 or graduates from high school, whichever occurs later. According to Ohio Revised Code 3119.86, parents are generally no longer legally required to provide financial assistance once this milestone is reached.

However, when college comes into the picture, the legal landscape becomes more complex. Unlike states such as New Jersey that mandate parental contributions, Ohio does not automatically require parents to pay for post-secondary education.

The Gray Area: College as an Extension of Support

While Ohio law doesn’t mandate college support, courts have the authority to order it under specific circumstances. This discretionary college support depends on the unique facts of each case, the financial resources of both parents, and whether requiring such support serves the child’s best interests.

Understanding when Ohio courts may impose this obligation helps parents in Franklin County, Cuyahoga County, Hamilton County, and across Ohio plan financially and avoid costly future disputes.

When Courts May Order College Support in Ohio

Ohio courts derive their authority to order college expense contributions from their broad equitable powers in domestic relations cases. The guiding principle is fairness: Would the child have attended college if the family had remained intact?

Key Factors Courts Consider:

Before determining whether to order college support, Ohio courts carefully review several aspects of the child’s and parents’ circumstances. Each factor helps the court assess fairness, the child’s needs, and the parent’s ability to contribute. Understanding these considerations can help parents prepare and anticipate how decisions might be made.

1. The Child’s Academic Ability and Potential

Courts carefully evaluate:

- High school GPA and class ranking – Students with strong records (typically 3.0+ GPA) are more likely to receive support

- Standardized test scores (SAT/ACT) demonstrating college readiness

- College acceptance letters proving qualification for higher education

- Academic awards, honors, and AP coursework

2. Parent’s Financial Resources and Income

Both parent’s complete financial pictures are reviewed:

- Gross annual income from all sources

- Assets, including real estate, retirement accounts, and savings

- Current debt obligations and standard of living

- Other financial obligations, including support for other children

A parent with greater financial means may be expected to contribute a higher percentage, though courts recognize that even high earners have limits.

3. The Family’s Pre-Divorce Standard of Living

This critical factor examines:

- Educational opportunities before separation – Did parents discuss college plans?

- Family income and lifestyle – Was college a realistic expectation?

- Educational background of parents – College-educated parents often set expectations

- Prior savings or 529 plans established for the child

- Siblings’ educational paths – Did older children attend with support?

Courts strive to maintain the educational standard the child would have experienced had the marriage remained intact.

4. The Child’s Relationship with Each Parent

Relationship quality matters. A cooperative parent-child relationship can influence decisions positively, while estrangement may reduce obligations. A student who refuses contact with a parent may find that the parent’s support obligation is eliminated.

5. The Child’s Own Financial Resources

Before determining parental contributions, courts assess:

- Academic scholarships and merit awards

- Need-based grants (Pell Grants, Ohio College Opportunity Grant)

- Part-time employment income

- Personal savings or trust funds

Courts typically expect students to maximize financial aid and contribute reasonably to their own education.

6. Prior Agreements Between Parents

Existing agreements carry significant weight. If parents previously agreed on paying for college in Ohio, whether formally in a divorce decree or informally during marriage, courts typically honor and enforce that arrangement.

Types of College Expenses Covered Under Ohio Law

When Ohio courts order college expense support, the obligation typically extends beyond tuition. The intent is to ensure the child has adequate resources to succeed academically.

Common College Costs Included

When Ohio courts order college support, the contributions are intended to cover essential costs that allow the student to succeed academically. These typically go beyond tuition alone and include expenses necessary for living, learning, and participating fully in college life. Understanding what is commonly included can help parents plan and budget effectively.

- Tuition and Mandatory Fees – Semester charges and mandatory university fees

- Room and Board – On-campus housing or reasonable off-campus rent (courts may cap at on-campus equivalent)

- Books and Academic Supplies – Required textbooks, lab materials, and course-specific supplies

- Transportation Costs – Commuting expenses or reasonable travel between home and campus

- Technology and Equipment – Laptop or computer required for coursework

- Other Reasonable Expenses – Health insurance if not covered under parent’s plan, application fees for graduate programs

What Courts Typically Won’t Cover

While courts aim to cover essential college-related expenses, they generally do not pay for items considered non-essential or extravagant. Knowing what is typically excluded can help parents set realistic expectations and avoid disputes over unnecessary costs.

- Luxury housing

- Non-essential entertainment

- Fraternity/sorority dues

- Spring break trips

- High-end electronics are not required for coursework

- Expensive vehicle payments

Calculating College Support Obligations in Ohio

Unlike standard child support, following Ohio’s statutory guidelines, college support has no fixed calculation formula. Courts use broad discretion based on several elements.

Income Proportionality Method

The most common approach:

- Parent A earns $80,000/year, Parent B earns $40,000/year

- Combined income: $120,000

- Parent A’s share: 66.7%, Parent B’s share: 33.3%

- Annual college costs: $30,000

- Parent A pays: $20,000, Parent B pays: $10,000

Caps and Limitations

Many Ohio courts may impose practical limits based on fairness and reasonableness, for example:

- Capping support at the cost of an in-state public university

- Limiting duration to four academic years

- Requiring students to maintain satisfactory academic progress (often defined as a GPA of 2.5 or higher)

- Financial Aid Deduction

Some Ohio courts may reduce the parent’s contribution by the amount of scholarships, grants, or other student aid the child receives. For example, if total college costs are $30,000 and a student obtains $8,000 in scholarships plus a $3,000 grant, the parent’s share might be considered on the remaining $19,000 – although the exact method will vary by case.

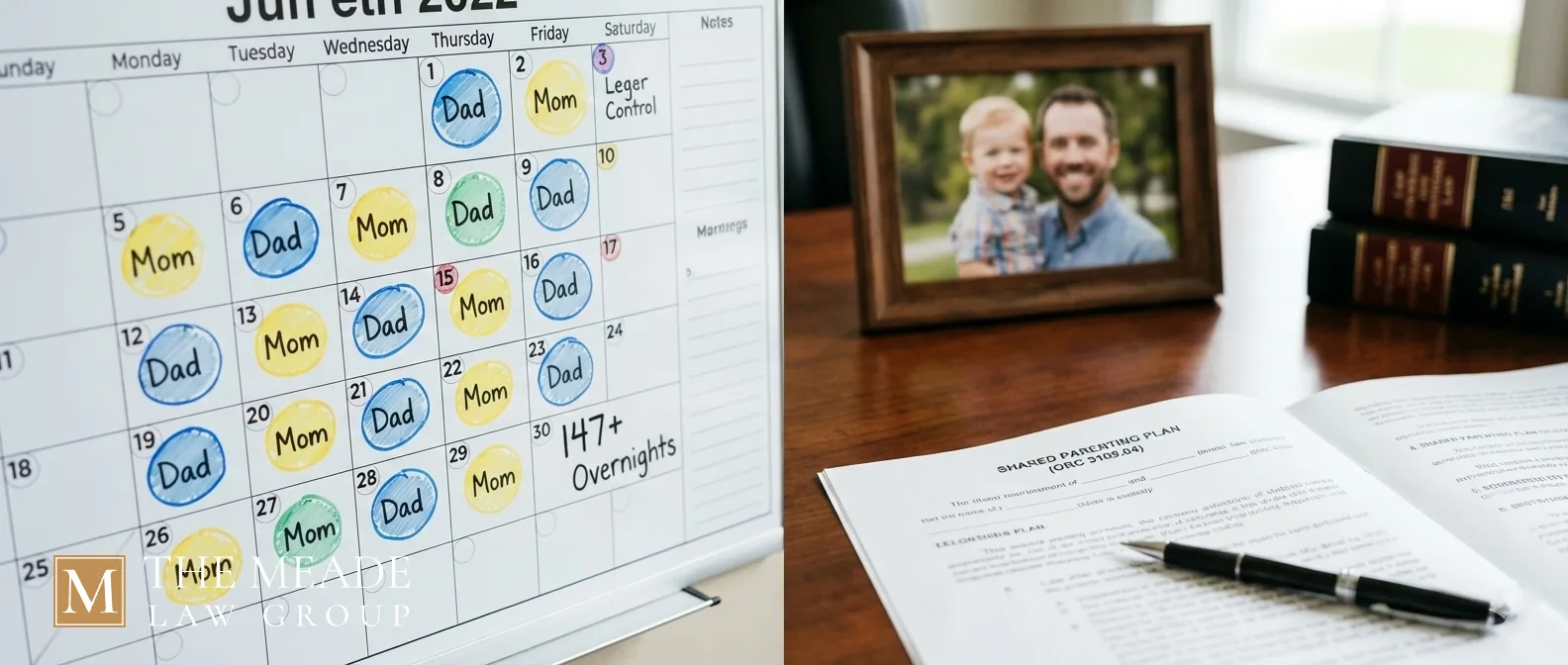

Parental Agreements and Court Involvement

Parents can often reach their own college expense agreement without court intervention, providing greater flexibility, reduced legal costs, faster resolution, and improved co-parenting relationships.

What Effective Agreements Should Include:

To ensure a smooth and fair arrangement, effective college support agreements clearly outline each parent’s responsibilities. Detailing the terms upfront reduces misunderstandings, provides financial clarity, and helps prevent future conflicts.

- Contribution Percentages – Clear percentage each parent pays

- Covered Expenses – Specific list of included costs

- School Selection Parameters – In-state vs. out-of-state, public vs. private

- Duration and Conditions – Maximum years (typically 4-5), GPA requirements, full-time enrollment expectations

- Payment Mechanisms – Direct payment to the university vs. reimbursement, payment schedules

- Modification Triggers – Circumstances allowing renegotiation

Working with experienced Ohio family law attorneys like The Meade Law Group ensures your rights are protected, whether negotiating privately or litigating disputes.

Modifying a College Support Order in Ohio

Even after a college support order is established, circumstances can change for both the child and the parents. Ohio law recognizes that financial situations, educational needs, and life events evolve over time. What was once a fair arrangement may no longer reflect current realities. Modifying an existing order ensures that support remains reasonable, achievable, and aligned with the best interests of the child.

Understanding when and how to request a modification, as well as the process involved, is essential for parents who want to maintain compliance while protecting their financial responsibilities and their child’s educational opportunities.

Valid Reasons for Modification

- Change in Child’s Academic Status – Significant GPA decline, withdrawal from college, transfer to a different institution.

- Change in Parent’s Financial Situation – Job loss, significant income reduction, serious medical issues, disability, bankruptcy

- Change in Educational Costs – Tuition increases exceeding expectations, loss of scholarships, and new financial aid opportunities

- The Modification Process

- File a motion in the court that issued the original order.

- Provide detailed documentation of changed circumstances.

- Attend a hearing.

- Not every change will lead to modification; courts evaluate whether the shift is significant enough.

Critical: Continue making payments per the current order until a court officially modifies it. Stopping payments without approval can result in contempt charges.

Enforcing College Support Orders in Ohio

When one parent refuses or fails to pay, Ohio courts have several enforcement tools:

- Wage Garnishment – Most common and effective method

- Tax Refund Interception – State and federal refunds seized

- Contempt of Court Proceedings – Potential fines or jail time

- Property Liens – Prevents the sale until the arrears are paid

- Credit Reporting – Damages credit score

- Professional License Suspension – Affects doctors, lawyers, contractors, etc.

Parents owed college support in Ohio should document all missed payments, communicate attempts to resolve, and consult a family law attorney promptly. The Meade Law Group can initiate enforcement proceedings quickly.

Planning Ahead: Including College Expenses in Divorce Settlements

The most effective way to prevent disputes over college expenses in Ohio is to address the issue early, during your divorce proceedings or in a separation agreement. Planning ahead provides clarity, reduces conflict, and ensures financial predictability for both parents and the child.

Key Elements to Include in Your Agreement

When creating a college expense agreement, it’s important to be clear, specific, and comprehensive. A well-structured agreement helps prevent misunderstandings, reduces conflict, and ensures both parents understand their financial responsibilities and the expectations for the child’s education. The following key elements outline what should be included to create an effective and enforceable plan that protects both the parents and the child’s future.

- Financial Contribution Framework – Clearly define the specific amounts or percentages each parent will contribute toward tuition, room and board, and other educational costs.

- School Selection Criteria – Set expectations for in-state vs. out-of-state schools, public vs. private, and the process for approving higher-cost options.

- Academic Performance Standards – Include minimum GPA requirements (typically 2.5-3.0) and expectations for maintaining full-time enrollment.

- Communication Protocols – Establish how grades, academic progress, and other updates will be shared between parents.

- Duration of Support – Specify the maximum number of years of support (commonly 4-5) and conditions for continuation or adjustment.

Why Early Planning Matters

By addressing college expenses before disputes arise, you can:

- Reduce uncertainty about financial responsibilities.

- Create a clear framework for saving strategies, such as 529 plans.

- Avoid costly and time-consuming court interventions in the future.

- Promote cooperative co-parenting and keep the focus on the child’s educational success.

Seeking Legal Advice from The Meade Law Group

Navigating child support and college expenses in Ohio can be complex and stressful, especially when family dynamics and emotions are involved. You don’t have to face these challenges alone. Consulting with an experienced family law attorney can provide clarity, confidence, and practical solutions tailored to your situation.

An attorney can help you understand your rights and obligations, evaluate your options, and develop a strategy that protects both your interests and your child’s educational future. Whether you’re negotiating a college support agreement, seeking a court order, or requesting a modification, having legal guidance ensures you make informed decisions every step of the way.

At The Meade Law Group, our team of skilled family law attorneys is dedicated to providing personalized, effective representation. We can assist in drafting agreements, navigating court proceedings, and enforcing or modifying existing orders. With our support, you can approach these matters with confidence, knowing that your child’s educational opportunities and your legal rights are fully considered.

If you have questions about child support or college expenses, reach out to The Meade Law Group today. Schedule a consultation and let us help you secure a fair, practical solution for your family’s future.